Anti Money Laundering Regulations 2017 Estate Agents

The concept of cash laundering is essential to be understood for those working in the financial sector. It's a course of by which dirty cash is converted into clear cash. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear cash and conceal the id of the felony part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new clients or maintaining present customers the duty of adopting sufficient measures lie on each one who is a part of the group. The identification of such ingredient to start with is straightforward to cope with as an alternative realizing and encountering such conditions in a while within the transaction stage. The central bank in any nation offers full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such situations.

However there is a lot of uncertainty as to the full scale of money laundering in lettings says ARLA Propertymark. A copy of the anti-money laundering policy must be given to all staff.

Pdf International Anti Money Laundering Programs

2 For the purposes of paragraph 1 estate agency work is to be read in accordance with section 1 of the Estate Agents Act 1979 1 estate agency work but for those.

Anti money laundering regulations 2017 estate agents. As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. The main purpose of this law is for the costs of fining businesses that do not comply with the Money Laundering Regulations. Our Anti-Money Laundering Policy Our agency is subject to the Money Laundering Regulations 2017 which aims to counter money laundering and the financing of terrorism.

On 26th June 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 more commonly referred to as The Money Laundering Regulations 2017 came in to force in the UK. Anti-Money Laundering Letting Agents From 10 January 2020 all letting agents who manage properties which individually yield an income of 10000 Euros per month or equivalent or more must now comply with regulations set out in the Fifth Money Laundering Directive. This should help to safeguard the UKs financial system and ensure that it is an increasingly.

The section on politically exposed persons has been update in the estate agency business guidance for money laundering supervision. A regulated business must comply with The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as amended by The Money Laundering and Terrorist Financing Amendment Regulations 2019 the Regulations which requires estate agents to have a written anti-money laundering policy in place. Anti-money laundering regulations 2017.

A regulated business must comply with The Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 as amended by The Money Laundering and Terrorist Financing Regulations 2019 which requires estate agents to have a written anti-money laundering policy in place. The MLR 2017 has expanded its definition to include domestic PEPs. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Money Laundering Regulations 2017. The Government thinks that the risk of money laundering taking place in estate agency is on the rise especially in high-end lettings the top 5 of lets in value. Anti-money laundering legislation to apply to letting agents.

The Criminal Finances Act 2017. Acceptable documents - Money Laundering Regulations 2017 As with all Estate Agents Foxtons is subject to the Money Laundering Regulations 2017. The overall objective of the transposition is to ensure that the UKs anti-money laundering and counter terrorist financing regime is kept up to date effective and proportionate.

The Terrorism Act 2000. We have a legal duty to obtain identification and proof of address from all our customers who include homeowners seeking to sell their property buyers Landlords who wish to rent out their property and tenants. Under the Regulations it is an offence to trade as an Estate Agent unless registered with HMRC for anti-money laundering supervision.

1 May 2019. The Proceeds of Crime Act 2002 and. Thistles Estate Agents are committed to complying with the Anti Money Laundering legislation AML.

1 In these Regulations estate agent means a firm or a sole practitioner who or whose employees carry out estate agency work when the work is being carried out. Implications for estate agents Posted on July 4 2017 March 29 2020 Author Silvia Del Corso Anti-money laundering regulations 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 came into force one week ago replacing the ten years older version. Detecting Suspicious Transactions And Reducing Risks in Estate Agents.

This means that we have to obtain and hold identification and proof of address for all customers. As of July 25 2018 HMRC brought a criminal administration charge for all fines of anti-money laundering controls. The Bribery Act 2010.

Pdf Anti Money Laundering Regulation And The Art Market

European Union Money Laundering Directives Overview Cams Afroza

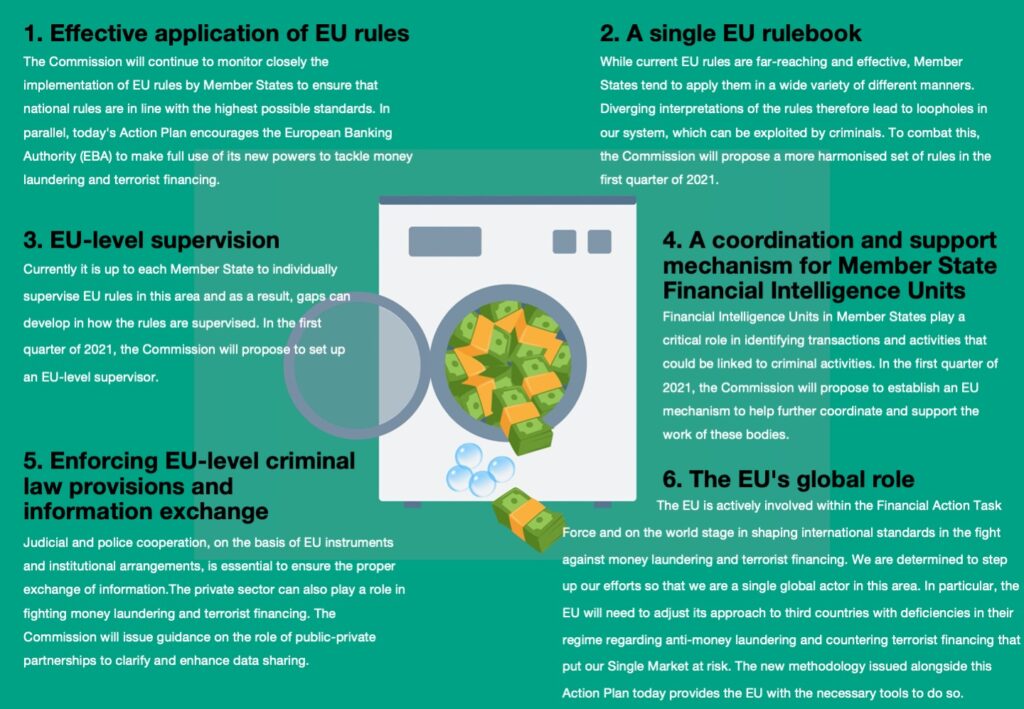

When One Door Shuts Another One Opens The Commission S New Aml Action Plan Planet Compliance

Pdf Combating Money Laundering And The Financing Of Terrorism A Survey

Pdf Anti Money Laundering Regulations And Its Effectiveness

Reporting Suspected Money Laundering And Terrorist Financing English By Finansinspektionen Issuu

Combating Money Laundering And The Financing Of Terrorism A Comprehensive Training Guide Workbook 1 Effects On Economic Development And International Standards

Registered Under Anti Money Laundering Legislation Aml In North Wales 16 Trinity Square Llandudno Serviced Offices Conwy North Wales

Anti Money Laundering Policy Fortes Estates

Pdf Eu Anti Money Laundering Regime An Assessment Within International And National Scenarios

Papua New Guinea Anti Money Laundering And Combating The Financing Of Terrorism Mutual Evaluation Report

Anti Money Laundering 2021 The Anti Money Laundering Act Of 2020 S Corporate Transparency Act Iclg

The world of laws can seem to be a bowl of alphabet soup at occasions. US cash laundering laws are no exception. We now have compiled a list of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending monetary services by lowering danger, fraud and losses. We've massive financial institution expertise in operational and regulatory threat. We've got a strong background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adversarial consequences to the organization due to the dangers it presents. It will increase the chance of major dangers and the chance value of the bank and finally causes the bank to face losses.

Komentar

Posting Komentar